PAN Aadhaar Link 2023: The Indian government has made it mandatory for all taxpayers to have a PAN card to link it with their Aadhaar card. The deadline for linking PAN with Aadhaar has been extended several times in the past due to various reasons, but the latest deadline is 30th June 2023. If PAN-Aadhaar linking is not done within this deadline, the PAN card will become inoperative from 1st July 2023.

Why Link PAN with Aadhaar?

Linking PAN with Aadhaar has several benefits. It helps in reducing tax fraud and maintaining transparency in financial transactions. It also helps in eliminating duplicate PANs which are often used to evade taxes. Moreover, linking PAN with Aadhaar makes it easier for taxpayers to file their income tax returns.

Penalty for Not Linking PAN with Aadhaar

If you do not link your PAN card with your Aadhaar card before 30th June 2023, your PAN card will become inoperative from 1st July 2023. This means that you will not be able to use your PAN card for any financial transactions. To reactivate your PAN card, you will have to link it with your Aadhaar card and pay a penalty of Rs.1,000.

How to Check if Your Aadhaar is Linked to Your PAN Card?

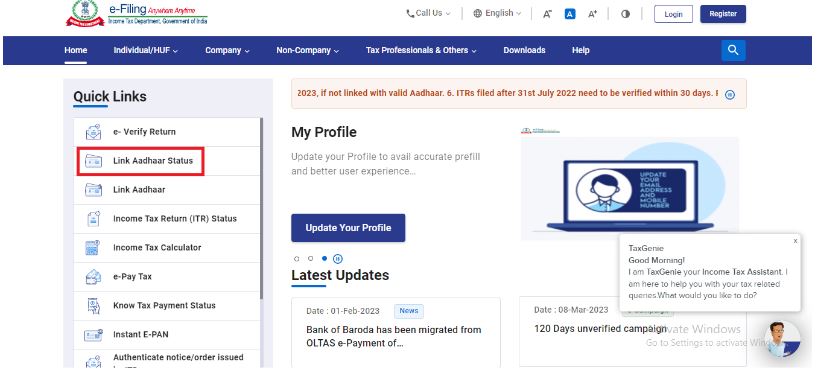

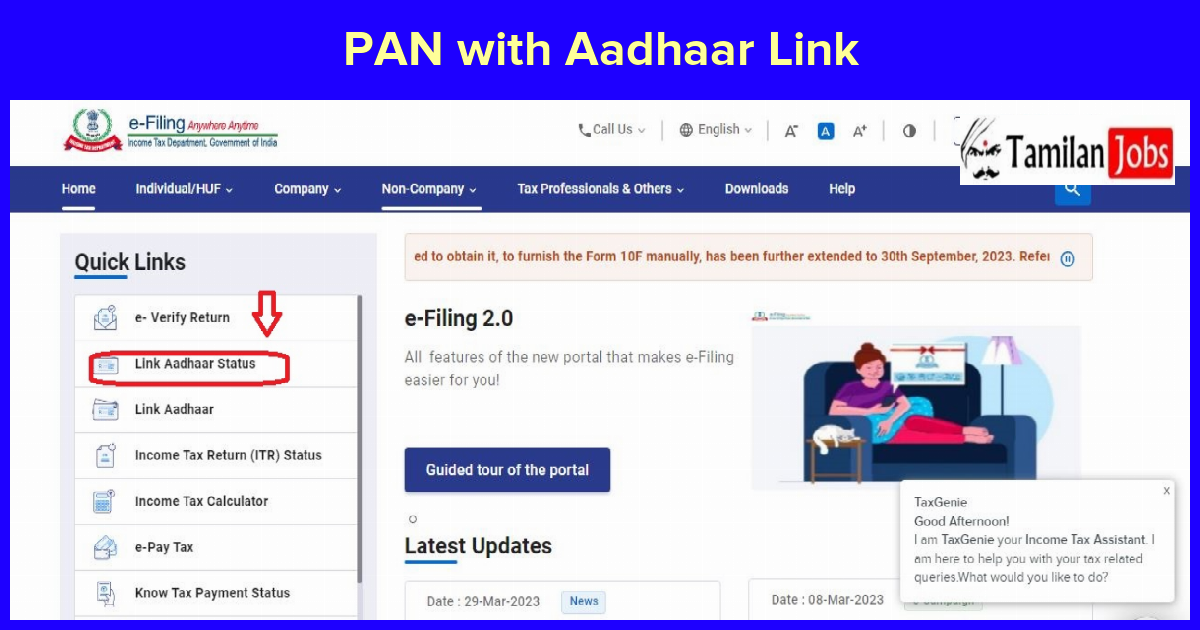

- Visit the Income Tax e-filing portal (https://www.incometax.gov.in/iec/foportal/).

- Click on the ‘Link Aadhaar Status’ option under the quick links on the homepage.

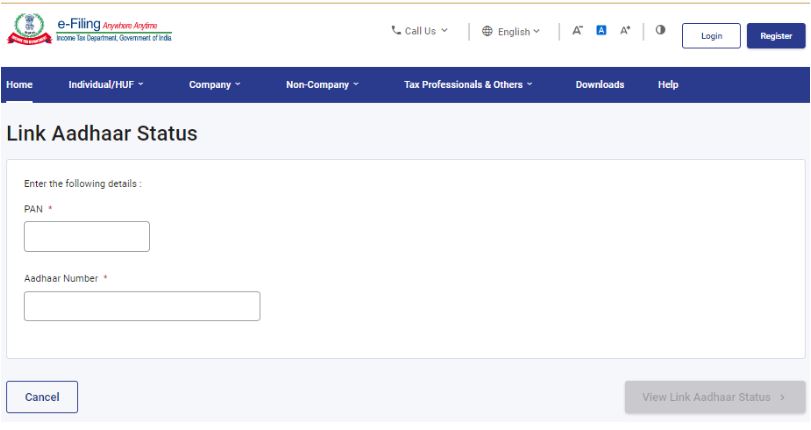

- Enter your PAN and Aadhaar number.

- Click on ‘View Link Aadhaar Status’.

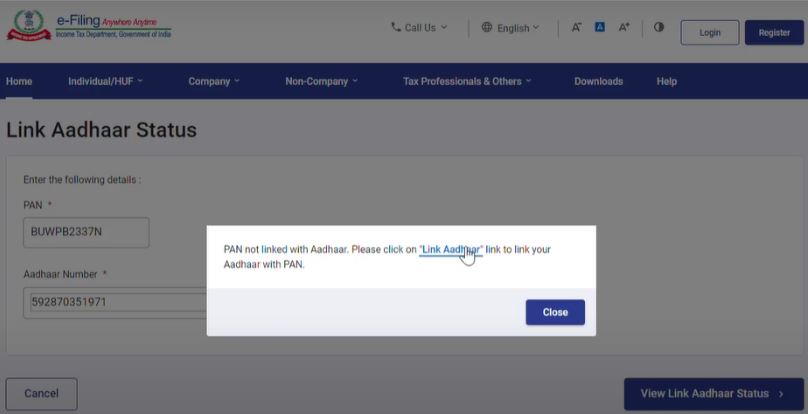

- If your PAN and Aadhaar are not linked, a pop-up will appear with instructions on how to link them.

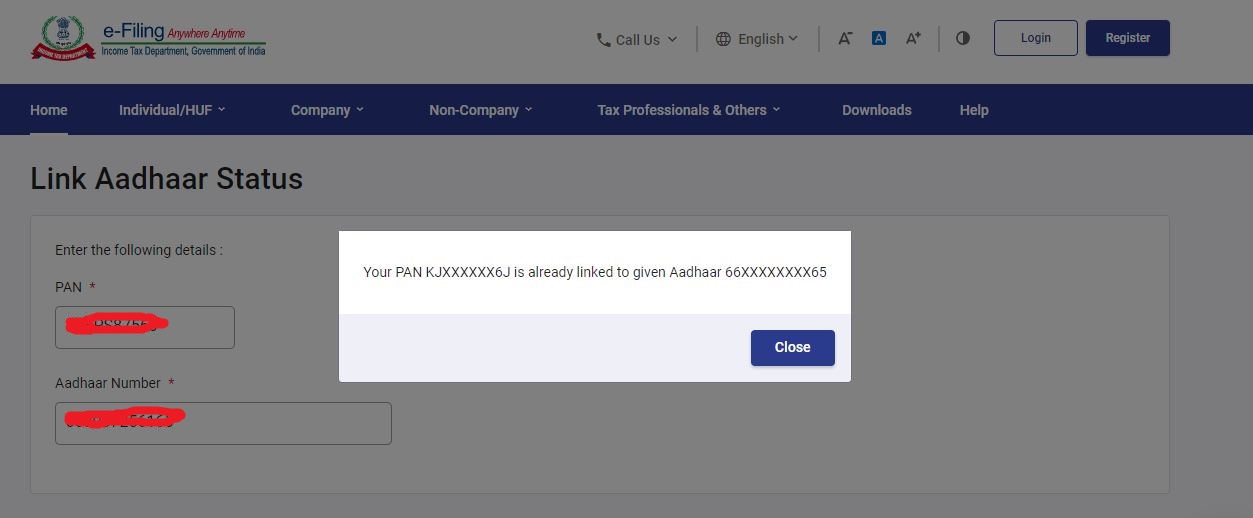

- If your PAN and Aadhaar are already linked, you can proceed with your Income Tax filing.

Check Aadhaar is Linked to Your PAN Card

Note: Linking PAN with Aadhaar is mandatory for all taxpayers and should be done before 30th June 2023 to avoid any penalties. The process is simple and can be done online or offline. Once linked, it helps in reducing tax fraud and maintaining transparency in financial transactions.