Linking Your Aadhar with Your PAN in 2023: The Indian government has made it mandatory for individuals to link their Aadhar card with their PAN card. The deadline for linking Aadhar with PAN has been extended. In this article, we will discuss the two main steps to link Aadhar with PAN, the required documents, payment of fee on the NSDL portal, and the different ways to submit the Aadhar-PAN link request.

Payment of fee on the NSDL portal

- Go to the tax payment page and select ‘Challan no./ITNS 280’ under the Non-TDS/TCS category.

- On the next screen, select head ‘(0021)’ and then ‘(500)’.

- Fill in your PAN and choose Assessment Year 2023-24.

- Enter your address and other required details.

- Select your preferred mode of payment (debit card, credit card, net banking, or demand draft).

- Make the payment and note down the transaction ID for future reference.

- Wait for 4-5 days before submitting the PAN-Aadhaar link request.

- To submit the request, visit the NSDL website or Income Tax e-filing website.

- Provide your PAN, Aadhaar number, name as per Aadhaar, and date of birth.

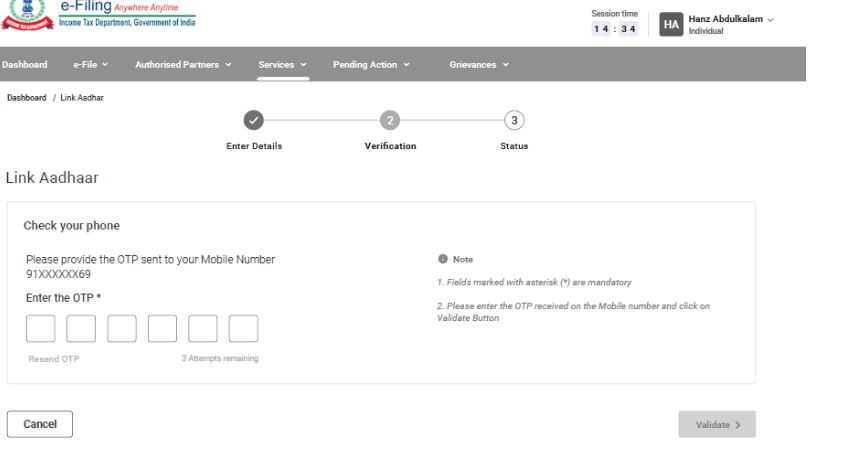

- Enter the OTP received on your registered mobile number.

- Click on submit to complete the process.

Submit the Aadhaar-PAN link request Once the fee is paid

the next step is to submit the Aadhaar-PAN link request. There are three ways to submit the request:

- Online submission: You can submit the request online on the NSDL portal or the Income Tax e-filing website. You will need to provide your PAN, Aadhaar number, name as per the Aadhaar, and date of birth. After submitting the request, you will receive an OTP on your registered mobile number. Enter the OTP and click on submit to complete the process.

- Offline submission: You can download the form from the NSDL website, fill it out, and send it to the NSDL office in Mumbai. The form should be accompanied by a photocopy of your PAN and Aadhaar card.

- SMS submission: You can also link your Aadhaar with your PAN by sending an SMS to 567678 or 56161. The format of the SMS should be UIDPAN<SPACE><12-digit Aadhaar number><SPACE><10-digit PAN number>. For example, UIDPAN 123456789012 ABCDE1234F.

Required Documents to Link Aadhar with your PAN

with PAN, you will need the following documents:

- Aadhaar card

- PAN card

- Registered mobile number with Aadhaar

- Demand draft, if the fee is paid through demand draft

How to link your PAN to your Aadhaar?

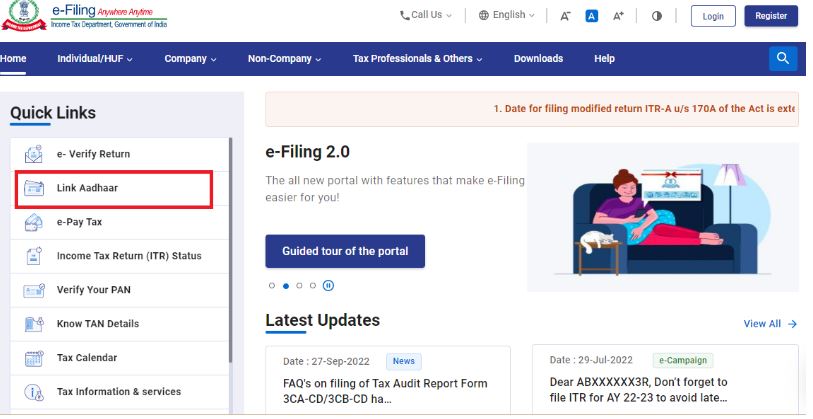

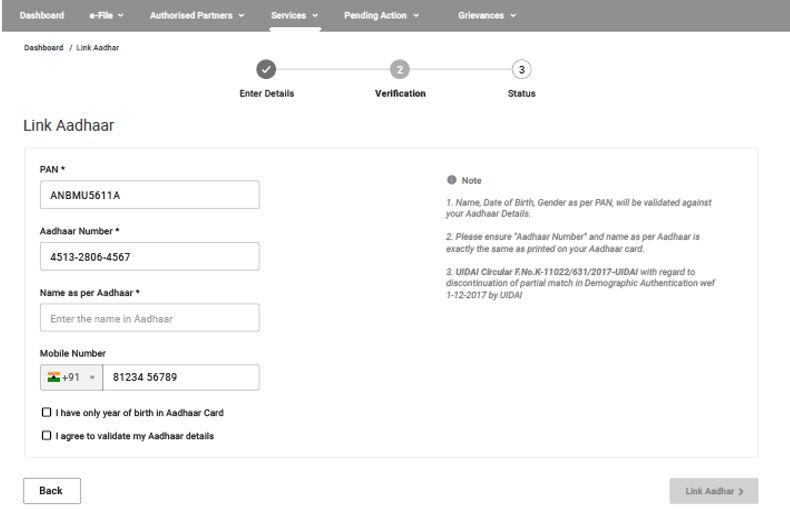

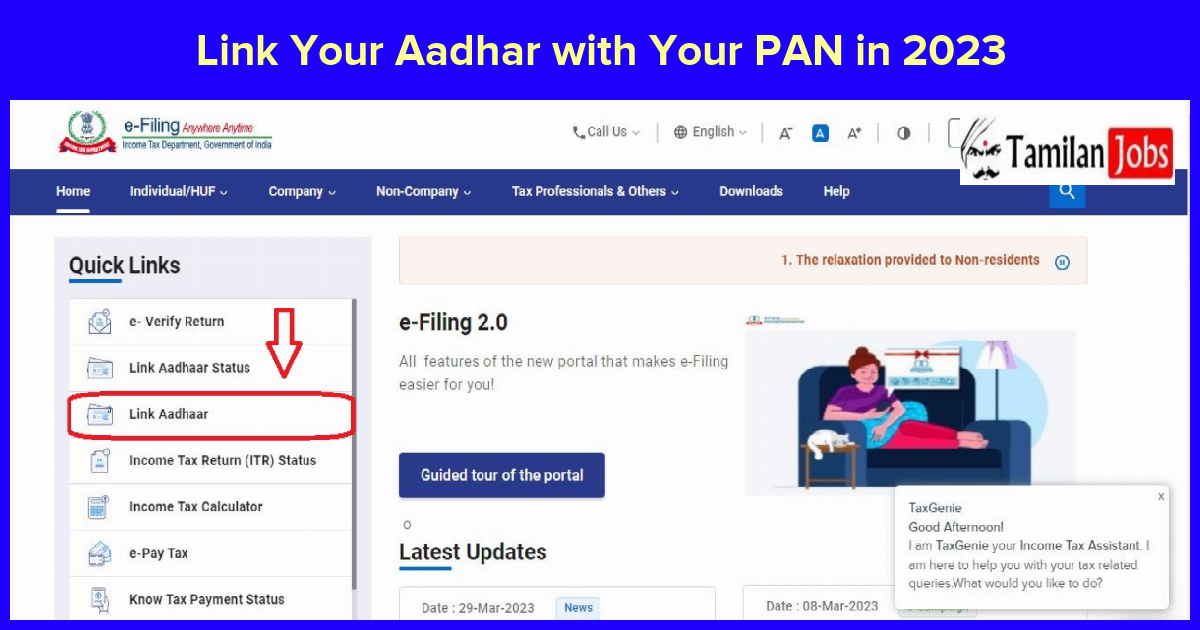

- Go to the Income Tax e-filing portal and click on the ‘Link Aadhaar’ tab.

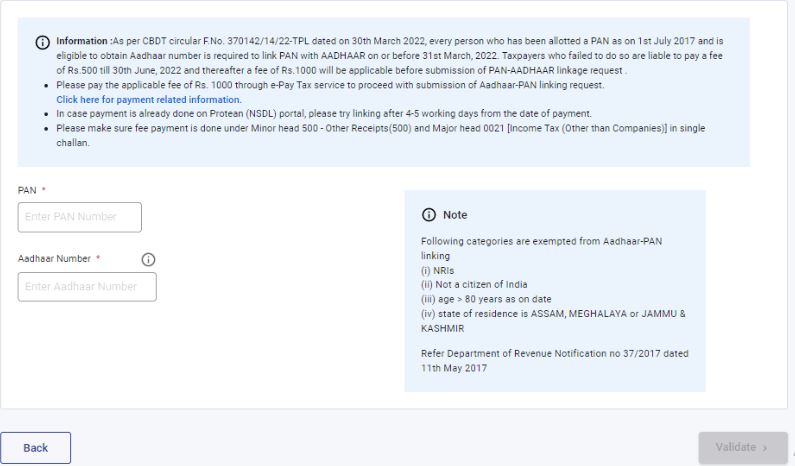

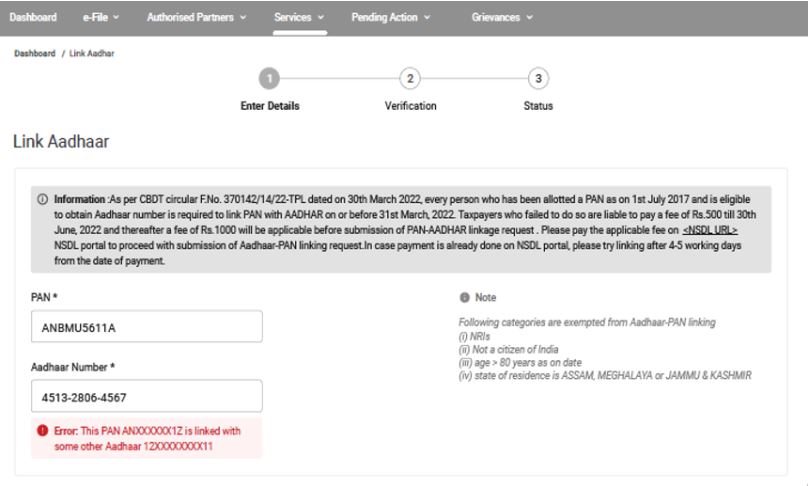

Link Your Aadhar Card 2023 - Enter your PAN and Aadhaar number.

Link Your Aadhar Card 2023 - Verify your PAN and Aadhaar.

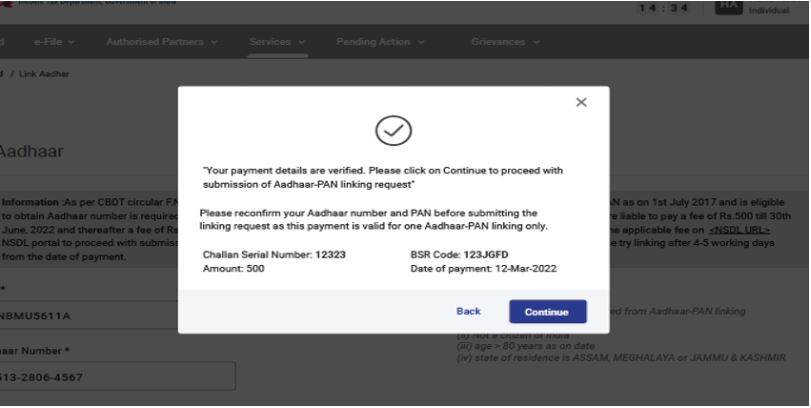

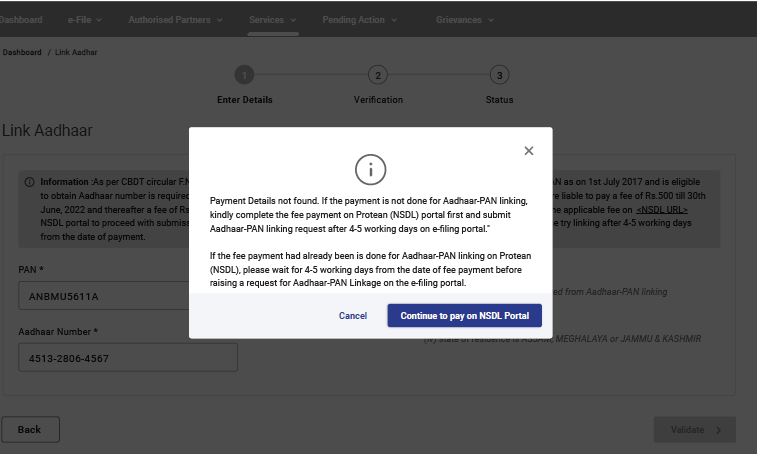

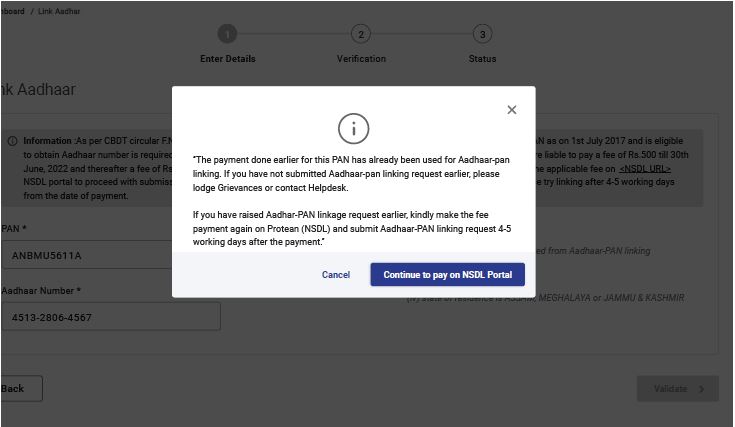

Link Your Aadhar Card 2023 - There could be three scenarios after validation – Payment details are verified, Payment details are not verified, and Record for PAN and minor head code 500 is there, but the challan is already consumed for linking.

Link Your Aadhar Card 2023 - If payment details are verified, a pop-up message saying ‘Your payment details are verified’ will appear. Click on ‘Continue’ to submit the ‘Aadhaar link’ request.

- Enter the required details and click the ‘Link Aadhaar’ button.

Link Your Aadhar Card 2023 - Enter the 6-digit OTP received on your mobile number and validate.

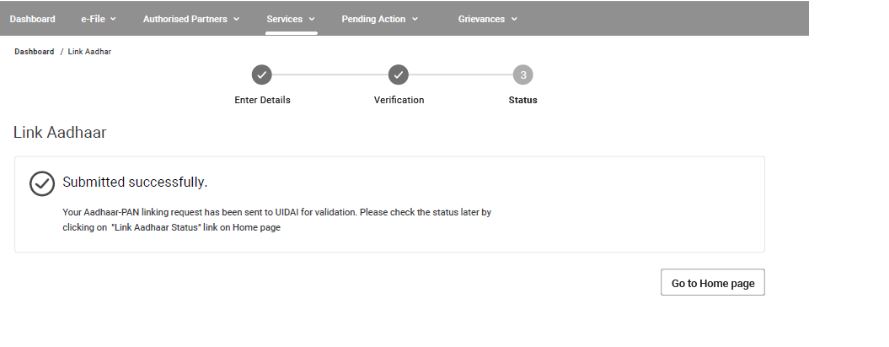

Link Your Aadhar Card 2023 - Your request see a success message on the screen. You may now check your Aadhaar-PAN link status.

Link Your Aadhar Card 2023 - If payment details are not verified, complete the payment on the NSDL portal and submit the link request after 4-5 working days.

Link Your Aadhar Card 2023 - If the record for PAN and minor head code 500 is already there, but challan is already consumed for linking, make the fee payment again on NSDL and submit the Aadhaar-PAN linking request after 4-5 working days.

Link Your Aadhar Card 2023

Logging in to Your Account (6-Step Procedure)

- If you are not already registered, register yourself at the Income Tax e-filing portal.

- Log in to the e-filing portal by entering your user ID and password.

- Click on ‘Link Aadhaar’ or go to ‘My Profile’ and select ‘Link Aadhaar’ under the ‘Personal Details’ option.

- Enter your details such as name, date of birth, gender, and Aadhaar number. Verify the details on the screen with the ones mentioned on your Aadhaar card.

- Give your consent by selecting the check box ‘I agree to validate my Aadhaar details’. If only the year of birth is mentioned on your Aadhaar card, select the check box asking ‘I have only year of birth in Aadhaar card’.

- Click on the ‘Link Aadhaar’ button. A pop-up message will confirm that your Aadhaar number has been successfully linked to your PAN card.

Check How to Linking Your Aadhar with Your PAN in 2023

How to Check Aadhaar is Linked to Your PAN Card (Check Here)

Note: Linking your Aadhaar with your PAN is a simple process that can be completed online, offline, or through SMS. It is important to link Aadhaar with PAN to avoid any penalties or fines. So, if you have not linked your Aadhaar with your PAN yet, do it before the deadline of March 31, 2023.