Kerala PSC Branch Manager Syllabus 2022 Check Exam Pattern & Download: Hello folks Are you applied for the Kerala PSC Branch Manager then this article is Very Much useful to you read the entire article. Because this page going to discuss the Exam Patten and exam syllabus 2022 for the position of Branch Manager. The applicants who applied and searching for the Branch Manager Exam Pattern and syllabus can download it from here or else at the end of the article attached the pdf link make use of it.

Kerala PSC Branch Manager Syllabus 2022 & Exam Pattern

| Download Kerala PSC Branch Manager Exam Pattern & Syllabus 2022 | |

| Organization Name | Kerala Public Service Commission |

| Name of the post | Branch Manager |

| Category | Syllabus |

| Syllabus Status | Available |

| Location | Kerala |

| Official site | keralapsc.gov.in |

Kerala Branch Manager Exam Pattern 2022

| Topics | Marks | Questions Types | Duration |

| Theory & Principles Of Co-Operation | 10 | Multiple Choice Questions | 1 Hour 30 Minutes |

| Co-Operative Legal System | 12 | ||

| Co-Operative Banking In India | 10 | ||

| Management Of Agri-Business Co-Operatives | 10 | ||

| Co-Operative Accounting | 10 | ||

| Co-Operative Audit | 12 | ||

| Banking Law & Practice | 12 | ||

| Financial Management | 8 | ||

| Marketing Management | 8 | ||

| Human Resource Management | 8 | ||

| Total | 100 |

Kerala PSC Branch Manager Exam Syllabus 2022

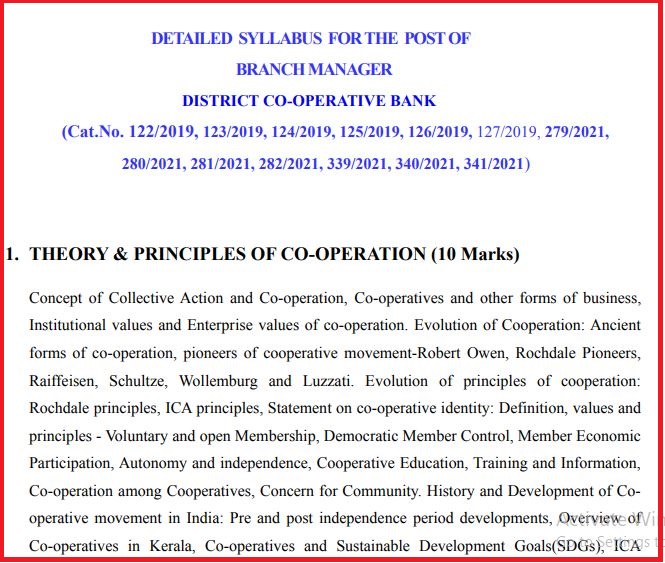

Theory & Principles of Co-Operation (10 Marks):

Concept of Collective Action and Co-operation, Co-operatives and other forms of business, Institutional values and Enterprise values of co-operation. Evolution of Cooperation: Ancient forms of cooperation, pioneers of cooperative movement-Robert Owen, Rochdale Pioneers, Raiffeisen, Schultze, Wollemburg, and Luzzati. Evolution of principles of cooperation: Rochdale principles, ICA principles, Statement on co-operative identity: Definition, values and principles – Voluntary and open Membership, Democratic Member Control, Member Economic Participation, Autonomy and independence, Cooperative Education, Training and Information, Co-operation among Cooperatives, Concern for Community. History and Development of Cooperative movement in India: Pre and post independence period developments, Overview of Co-operatives in Kerala, Co-operatives and Sustainable Development Goals(SDGs), ICA Blueprint for a co-operative decade.

Co-Operative Legal System (12 Marks)

History of co-operative legislation in India: Co-operative Credit Societies Act1904-essential features, Co-operative Societies Act 1912-essential features. Special features of Report of the Committee on Model Co-operative Societies Act 1991. Multistate Co-operative Societies Act 2002- objects need, application, registration, rights and liabilities of members, management, audit, inquiry, and winding up. 97th Constitutional Amendment Act 2011- Historical Perspective. History of co-operative legislation in Kerala. Important provisions of Kerala Cooperative Societies Act and Rules 1969: Registration, Amendment of bye-laws, amalgamation and division, Membersrights and liabilities. Management of societies: general body, representative general body, committee, election, supersession. Properties and funds of cooperative societies, Disposal of net profit, Investments, Audit, Inquiry, supervision and inspection, Settlement of disputes, winding up and dissolution of co-operative societies. The organizational structure of the Department of Co-operation and the Directorate of Co-operative Audit. Functional Registrars. ILO Resolution 193-Recommendation concerning Promotion of Cooperatives.

Co-operative Banking in India (10 Marks)

Co-operative banking structure in India, classification, and need for agricultural credit, Organizations under short term and medium-term credit structure – Primary Agricultural Credit Societies (PACS), District Cooperative Banks (DCB), State Cooperative Bank (SCB) – objectives, functions, resources, lending operations. Organizations under a long-term credit structure – need long term finance, need for a separate agency. Primary Co-operative Agricultural and Rural Development Banks (PCARDB), State Cooperative Agricultural and Rural Development Banks (SCARDB) – objectives, functions, resources, loan operations. Urban Co-operative Banks in India – evolution, objectives, functions, structure, resources, loan operations. Employees Credit Societies – objectives, functions, resources, loan operations. Role of national federations: National Federation of State Cooperative Banks Ltd. (NAFSCOB), National Federation of Urban Cooperative Banks and Credit Societies Ltd. (NAFCUB), National Co-operative Agricultural & Rural Development Banks Fed. Ltd. (NCARDBF), Role of NABARD in co-operative credit.

Management of Agri-Business Co-Operatives (10 Marks)

Co-operative Management: concept, meaning, definition, unique features. Management structure: General body- BOD- President- Secretary. Concept of agri-business, need, significance, and types of agri-business co-operatives. Dairy co-operatives: history, Operation Flood Programmes, National Dairy Plan, types, objectives &structure of Dairy Cooperatives. Processing Co-operatives: need, objectives, and functions. Marketing Co-operatives: importance, objectives, functions, and types. Structure and special features of other types of cooperatives: Fisheries Co-operatives, Weavers Co-operatives, Coir Cooperatives. Role of state federations, national federations, and other promotional agencies promoting agri-business cooperatives: MARKETED, KERAFED, RUBBERMARK, KCMMF, NAFED, NCDC, NCDFI, NDDB, IFFCO, KRIBHCO.

Co-Operative Accounting (10 Marks)

Introduction concepts and conventions of accounting. Meaning and Definition of Bookkeeping. The double-entry system of bookkeeping. A practical system of Accounting. Bank reconciliation statement. Concepts of Capital and Revenue. Preparation of trial balance and preparation of Final accounts. Depreciation accounting – Methods of depreciation. Indian Accounting Standards, Co-operative Accounting-meaning and scope, Salient Features, Cooperative Accounting Vs Double Entry and Single Entry System. Books and registers maintained by co-operative societies- daybook, ledgers. R & D Statement, Final Accounts.

Co-Operative Audit (12 Marks)

Audit: meaning, definition, and objectives. Difference between audit and accounting. Types of audits. Co-operative Audit: definition, features, and objectives. Difference between co-operative audit and general audit, financial audit, and administrative audit. Internal control, internal check and internal audit, audit memorandum, levy of audit fees, powers of co-operative auditor, procedures of audit, directorate of a co-operative audit. Stages of audit work: audit program, vouching, routine checking, verification and valuation of assets and liabilities, assets classification, reserves, and provisions. Audit classification and Audit Certificate.

Banking Law & Practice (12 Marks)

Banking Legislation in India: Banking Companies Act, 1949 – Banking Regulation Act, 1949- objectives, important provisions: definitions – banking, banking company, approved securities, Demand and Time Liabilities; permitted and prohibited business of a banking company; capital requirements; maintenance of liquid assets; powers of the RBI – cash reserve, licensing of banking companies. Branch Licensing, Branch Authorisation Policy for Commercial Banks, Setting Up of a New Bank, New Bank Licensing Policy, 2013. Banker and Customer: general and special relationship between a banker and customer; obligations of the banker. Banking Ombudsman. Types of customers. operation and closing of different types of bank accounts. New types of accounts – Flexi deposits, tailor-made schemes, special types of bank customers. Accounts of Non-Resident Indians. Regulations regarding KYC/AML. Law relating to Negotiable Instruments: characteristics of negotiability, types, negotiation and assignment, endorsement; the crossing of cheques; collecting banker – legal status – statutory protection– duties; paying banker –dishonor of cheques, statutory protection, payment in due course, holder and holder in due course. Lien, pledge, mortgages, hypothecation, guarantee and indemnity, co-obligate, Digital Banking- ATM card, Debit card, credit card, mobile banking, internet banking

Financial Management (8 Marks)

Introduction to financial management. Functions of a finance manager. Time value of money. Financial forecasting. Capital budgeting decisions and techniques. Sources of Long Term finance. Cost of Capital. Capital structure: importance, factors influencing, features of an optimal capital structure, theories of capital structure – Net Income Approach, Net Operating Income Approach, Miller and Modigliani Approach. Leverage: leverage in the financial context, measures of leverage. Dividend policy: Dividend decision, theories of dividend policy – Traditional Approach, Walter Model, Gordon’s Dividend Capitalisation Model, Miller Modigliani Model, Rational Expectation Model. Estimation of Working Capital Requirements: Concept, factors affecting the working capital, operating cycle approach, criteria for evaluation of working capital management. Inventory Management: nature, role, purpose, types, costs, inventory management techniques. Receivables Management: purpose and cost of maintaining receivables, credit policy, credit-granting decisions, monitoring receivables. Cash management: liquidity – profitability trade-off, need, and objectives, cash budget, factors for efficient cash management.

Marketing Management (8 Marks)

Marketing – Definitions and Concepts. Roles of Marketing managers. Market segmentation, Targeting, and Positioning. Market structure, Conduct, and Performance. Types of Marketing Marketing Management- Meaning and Importance of Marketing Management. Elements of Marketing Management process, Marketing environment marketing management policy and planning. 4 Ps of the marketing mix, Product, Price, Promotion, and Physical distribution. Developing marketing strategies –Product strategies Pricing strategies Marketing communication strategies and Channel management strategies. Social, Ethical and Ecological issues in Marketing.

Human Resources Management (8 Marks)

Human Resource Management – meaning, definition and importance. Acquisition of human resources – human resource planning, job analysis, recruitment, selection process, and devices. Development of human resources – training needs assessment, employee training, management development, career planning, and development. The motivation of human resources – concept, meaning, motivational theories. Performance appraisal methods and techniques. Rewards – types and criteria. Maintenance of human resources – compensation administration, benefits, and services disciplining employees, safety, and health. Co-operative education training and information-identification of education, training, and information needed in cooperatives – Institutional arrangement for co-operative training and development – NCUI, NCCT, NCCE, NCDC, NIRB, BIRD. Recruitment of human resources for co-operative sector in Kerala.

NOTE: – It may be noted that apart from the topics detailed above, questions from other topics prescribed for the educational qualification of the post may also appear in the question paper. There is no undertaking that all the topics above may be covered in the question paper

Steps To Download the Branch Manager Exam Pattern & Syllabus 2022

- Visi the Official site

- The home page will open

- Search for the recruitment tab

- Choose and click on the Branch Manager Syllabus and Exam Pattern

- The Pdf will open Download the syllabus PDF for further use.

Kerala Public Service Commission Official Site

Kerala PSC Branch Manager Syllabus and Exam Pattern 2022