RBI Repo Rate 2023: The Reserve Bank of India (RBI) is responsible for setting monetary policy in India, including the repo rate. The repo rate is the interest rate at which the RBI lends money to commercial banks. It is an important tool for managing inflation and controlling economic growth. In this article, we will explore the history of the RBI repo rate, the potential for a hike in 2023, and the impact it could have on the Indian economy.

RBI Repo Rate History

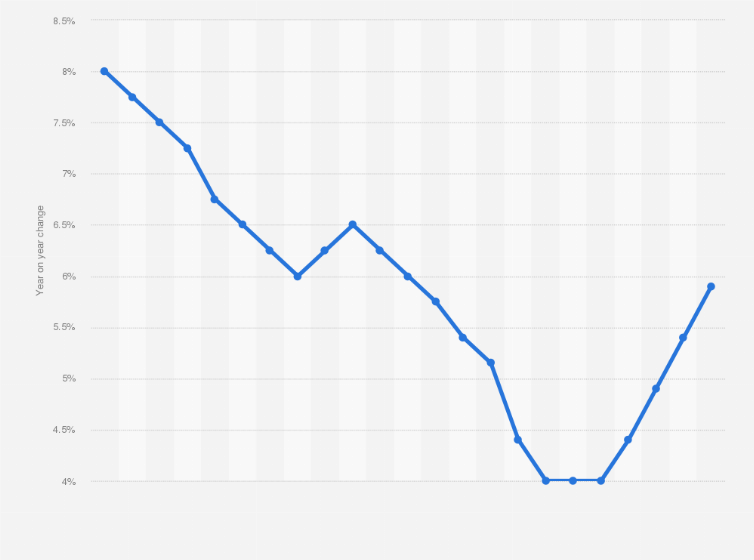

The RBI began publishing the repo rate in 2000, and since then, it has gone through several changes. In 2001, the repo rate was 8.0%. Over the next few years, it fluctuated between 4.75% and 7.5%. In 2008, the repo rate was raised to 9.0% due to rising inflation. In 2010, it was raised again to 8.5% before being gradually lowered to 6.0% in 2013. Since then, it has fluctuated between 5.15% and 6.75%, with the most recent rate being 6.0%.

RBI Repo Rate Graph and Chart

The RBI repo rate graph and chart are useful tools for visualizing the changes in the repo rate over time. These charts show the repo rate over the past two decades, allowing viewers to see how it has fluctuated in response to changes in economic conditions. They also show the impact of major events, such as the global financial crisis of 2008, on the repo rate.

RBI Repo Rate Hike 2023

There is speculation that the RBI may hike the repo rate in 2023. This speculation is based on several factors, including rising inflation, an increase in the price of crude oil, and a weakening rupee. The RBI has already raised the reverse repo rate, which is the rate at which the RBI borrows money from commercial banks, from 3.35% to 3.5%. This move is seen as a signal that a repo rate hike may be on the horizon.

High Impact Rate on RBI Repo

A repo rate hike can have a significant impact on the Indian economy. When the repo rate is increased, it becomes more expensive for commercial banks to borrow money from the RBI. This can lead to higher interest rates for consumers and businesses, which can slow down economic growth. On the other hand, a repo rate hike can also help to control inflation by reducing the amount of money in circulation. This can help to stabilize prices and prevent an inflationary spiral.

Note: The RBI repo rate is an important tool for managing the Indian economy. While the repo rate has remained relatively stable over the past few years, there is speculation that a hike may be on the horizon. If the RBI does decide to raise the repo rate in 2023, it will be important to monitor the impact on the economy and adjust policies as necessary.